Financial wellbeing for employees needs to be promoted

I recently met two young guys in the process of starting their own wealth management business who wanted to explain their financial wellbeing offering. I shared with them that over the past 6 months it seems that this is a topic increasingly being added to the corporate workplace agenda. With ‘Black Friday’ having come and gone and the Christmas spend nearly upon us, perhaps it’s even more timely to look at this issue.

Like mental health statistics, the figures around financial wellbeing are also quite startling. Aegon, one of the world’s leading providers of life insurance, pensions and asset management working with the Centre for Economic and Business Research produced a recent report on Financial Wellbeing in the workplace. See http://bit.ly/AegonCEBRReport

Some of their key findings were:

- 30% of employees agree they are just getting by financially

- Over 500,000 private sector employees have had to take time off in the last year due to their financial wellbeing leading to a loss of over 4.2 million days off work

- £1.56billion is the estimated costs of low financial wellbeing as a result of absenteeism and presenteeism.

- Only 5% of employees are offered support with their finances, with issues like high house prices and savings insecurity cited as a source of low financial wellbeing. 67% feel that support would be beneficial.

Managing personal finance is a significant problem

Financial wellbeing of employees should be on the corporate agenda as it is a significant problem. For example job losses and the associated reduction in income can add pressure to continue to spend to keep up with high-living friends. Often, we find people using multiple credit cards with a balance of several thousand pounds with very little to show for it.

Asking for help-either for practical help, or to be bailed out- carries a huge sense of shame. Often it is something that people feel they must deal with alone, at times even keeping it a secret from their partner or family. People will often wait until the point of bankruptcy before asking for help. Yet if the right help and advice reached them earlier in the process, this could have prevented their money problems from spiralling out of control.

In the foreword of the Close Brothers Financial wellbeing report 2019, Sir Cary Cooper, Professor of Organisational Psychology and Health at Manchester Business School and President of the CIPD (Chartered Institute of Personnel and Development) commented, “In this important report on employee financial wellbeing, the issues of concern are stark. 88% of businesses think their employees are worried about money, with nearly 20% of them saying that they think their employees are very unhappy with their financial state. This is supported by the employees, with 94% saying they are worried about money, and of concern to employers are the 77% suggesting that these money worries adversely affect them at work. Although some employers provide financial advice support for their employees, 55% don’t offer any support to improve employee financial wellbeing.” See https://www.closebrothersam.com/media/1969/the-financial-wellbeing-index.pdf

What could improve financial wellbeing?

The short answer is education and proactive support. One of the basic topics that people are struggling with is how to set a budget? This subject topped a recent survey of financial topics which advised that 81% of British adults wanted to know more about this.

We also have to process various ‘money milestones’ during our working life. Starting our first job can mean starting to pay student debts and to learn about the company pension scheme. Then there is the purchase of the first home. The average age of a first- time buyer in the UK is now 33. There is also parental leave and managing the costs of childcare and more experienced workers want to know more about maximising the benefits of pensions and company share save schemes.

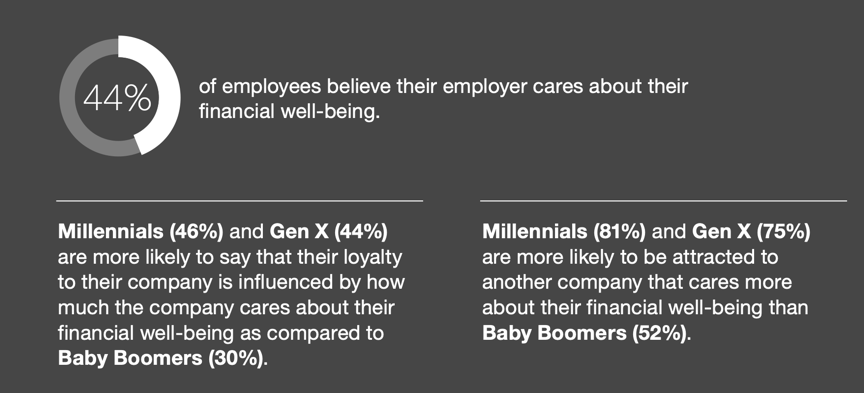

Financial wellbeing of employees should be on the corporate agenda. It is obvious there is a massive need and hunger for financial wellbeing education. Supporting employees with their financial wellbeing also makes sense in regard to the retention of staff as the following data from a PwC’s 8th annual Employee Financial Wellness Survey demonstrates.

How can we help?

P3 Business Care have relationships with experienced, regulated financial planners across the UK. Examples include St James’s Place Wealth Management, Acumen Financial Planning and Johnstone Carmichael Accountants.

The personal and proactive approach of our Business Partners when visiting our clients twice weekly allows us to develop trust and relationship with staff which is critical in giving them the confidence to disclose their financial concerns and situation. We can then make a confidential introduction to support.

We can also arrange financial planning workshops/ lunch and learns/ one to one advice etc., that will help provide the education so clearly identified as a need of employees from current research.

Please get in touch to find out more.

About P3 Business Care

P3 Business Care is a Community Interest Company and social enterprise operating across the UK. Visiting your business on a weekly basis we provide personal and proactive support to your employees working in partnership with the company. We develop trust & relationships so we can identify and address issues before they become absence or staff turnover. Read more about our services here